LexCorp, an accrual basis corporation, has taxable income of $150,000 in the current year. Included in its determination of taxable income are the following transactions. ∙ It incurred a $65,000 capital loss from the sale of stock. It had no capital gains. It received $30,000 in dividends from Metallo, Inc. It owns 65%. ∙ It paid Federal income tax of $40,000. ∙ It incurred $18,000 in meal and entertainment expenses. ∙ LexCorp uses the LIFO method when accounting for inventory. This year, the company’s LIFO recapture amount increased by $4,000. ∙ It paid $5,000 in key man insurance premiums; cash surrender value increased by $1,500 . What is LexCorp's’s current E & P for the year?

Wage and Tax Statement Data on Employer FICA Tax

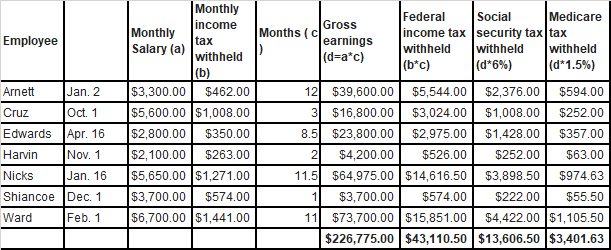

Ehrlich Co. began business on January 2, 20Y8. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in 20Y9, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administration, the employees' earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5%. Data on dates of employment, salary rates, and employees’ income taxes withheld, which are summarized as follows, ...

Comments

Post a Comment